postmates tax form online

Bad company behavior belongs elsewhere. Founded in 1996 this is the most trusted company if you are looking for remote jobs.

The Ultimate Guide To Taxes For Postmates Stride Blog

DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip.

. Schedule C Form 1040 Line 9. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Resort Tax Calculator FilePay Resort Tax Sign-in.

When you refer someone to join Postmates both of you receive 10 in credit. Money is deposited into couriers accounts weekly. As a DoorDash delivery driver youre an independent contractor not an employee.

Car truck scooter or motorcycle. Resort Tax Registration Form. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Maximize your tax write-offs. Here are the top tax deductions for real estate agents in 2022. Much of his experience centers on the business world including work for a major regional business newspaper and a global law firm.

This is not the place to promote your business. Postmates receive 80 of the delivery fee and 100 of any tips they make. Get a tax registration certificate and a vocational license if required for your profession.

A simple tax return is Form 1040 only OR Form 1040 Unemployment Income. Postmates receive 80 of the delivery fee and 100 of any tips they make. To receive a delivery customers must place a minimum order of 10.

Customers can also place a delivery order on the Chipotle app or website. Launch your business get financing and manage expenses. To succeed youve got to think like a business owner.

You can get these forms from the. Has been a professional writer since 2004 including print and online publications. W-2 income limited interest and dividend income reported on a 1099-INT or 1099-DIV claiming the standard deduction Earned Income Tax Credit EIC child tax credits unemployment income reported on a 1099-G.

Accept payments online in person or through your platform. 1099 forms are sent to freelancers or contractors by the person or company that paid them. You can deduct one-half 50 of the self-employment tax you pay on line 27 of your Form 1040 regardless of whether you itemize or take the standard deduction.

Form 1099 is actually a collection of forms that report non-wage income including self-employment income to the IRS. Working Solutions is a call center company hiring for positions like customer care sales consultant and data entry. The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year.

Self-Employed defined as a return with a Schedule CC-EZ tax form. There is a 4 tax on the rent of a room or rooms in any hotel motel rooming house or apartment house and a 2 tax levied on the total sales price of all food beverages alcoholic beverages including beer and wine sold in any restaurant bar or nightclub. Car truck scooter or motorcycle.

Americas 1 tax preparation provider. Created Sep 17 2007. What savings can I find in the Chipotle app.

And whats one thing all responsible business owners do. Chipotles delivery partners include Grubhub Uber Eats Postmates and DoorDash. 1 online tax filing solution for self-employed.

Automate fraud prevention tax revenue management and more. The tax forms you get as a Postmates driver. Particularly difficult for gig workers who work for online hiring platforms like Uber Lyft TaskRabbit Upwork Postmates and many others.

Here is a roundup of the forms required. Self-Employment Tax with your Form 1040 tax return each April. DoorDash dashers will need a few tax forms to complete their taxes.

Caviar generally huddles in the middle of the pack on all variables though its service fee is pretty hefty. Connection to article submissions is not allowed. The application process involves filling out an online form and taking an assessment test.

As it relates to the 2021 tax season when you file taxes for income earned in 2020 the businesses that paid you for on-demand work may send forms to the IRS to report those payments. Spamming will result in an instant ban. An additional service fee may apply to the order.

Postmates gets the triple-whammy of high markup high service fee and high delivery fee. Embed financial services in your platform marketplace or business. Keep things business casual.

Situations covered in TurboTax Free Edition includes. Meet n Beat Lowest Price Guarantee. Take advantage of tax write-offs.

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates Taxes The Complete Guide Net Pay Advance

How To Get Postmates Tax 1099 Forms Youtube

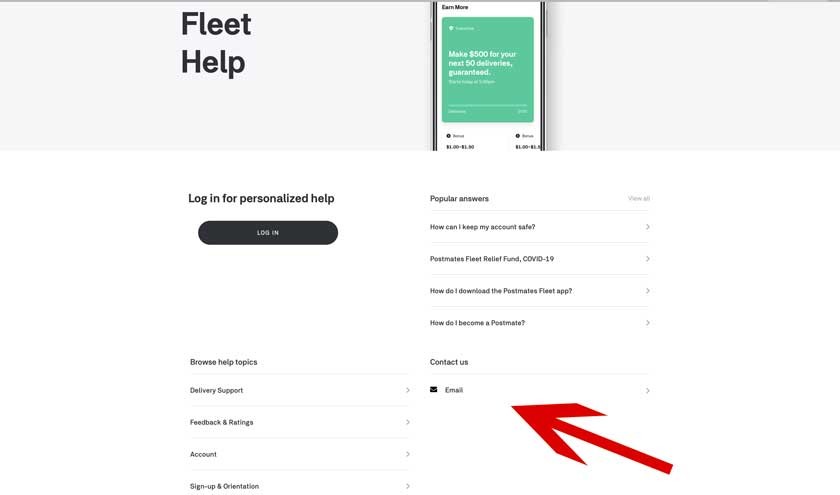

4 Easy Ways To Contact Postmates Driver Customer Support

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How To Get Your 1099 Form From Postmates

How Do Food Delivery Couriers Pay Taxes Get It Back

Postmates 1099 Taxes Your Complete Guide To Filing

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

The Ultimate Guide To Taxes For Postmates Stride Blog

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Postmates Taxes The Complete Guide Net Pay Advance

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Postmates Driver Requirements 2021 Review Background Check

How To Get Your 1099 Form From Postmates

Postmates Taxes The Complete Guide Net Pay Advance

Postmates 1099 Taxes The Last Guide You Ll Ever Need